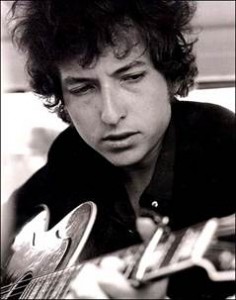

NEFMA Spring Conference: Experts Emphasize “The Times, They Are A Changin'”

They might as well have been a band of Bob Dylan’s. From the very start the presenters at the New England Financial Marketing Association Spring Conference all strummed one similar cord: banking consumers have evolved so banks better change as well or “you’ll sink like a stone.”

Change was on everyone’s minds at the conference’s first event on the afternoon of April 24. The results of the Shark Tank-like “Steal This Idea!” competition to rethink personal and business checking were all focused on meeting the evolved needs of today’s customers. The winners, a personal checking product called “I-Checking” and a business checking product that focused on creating connections with the community, were chosen by the judges because, in the words of one judge, “your willingness to go where the customers are.” Put another way, both products engage their customers in new ways that respond to changing lifestyles, new business needs, and of course, the continual digitalization of many aspects of our daily lives.

Change was on everyone’s minds at the conference’s first event on the afternoon of April 24. The results of the Shark Tank-like “Steal This Idea!” competition to rethink personal and business checking were all focused on meeting the evolved needs of today’s customers. The winners, a personal checking product called “I-Checking” and a business checking product that focused on creating connections with the community, were chosen by the judges because, in the words of one judge, “your willingness to go where the customers are.” Put another way, both products engage their customers in new ways that respond to changing lifestyles, new business needs, and of course, the continual digitalization of many aspects of our daily lives.

Day Two started with a beautiful sunrise over the Atlantic, but the song remained the same. A new NEFMA logo, created by member Sundin, Inc. was introduced representing a new direction for the organization. During the first presentation “Creating a Profitable Omni Channel,” Addison Hoover, General Manager of Branch Transformation Marketing at NCR Corporation, suggested that consumer demands where changing rapidly and that the successful banks of the future would respond to them. He noted that banks were starting to experiment with new designs to incorporate new technology and get customers to hang out. Here is one example of that kind of design by GCAi client PeoplesBank. Hoover also explained that countries with high smart phone penetration amongst consumers also have correspondingly high mobile transactions. This trend, and many others that he stated, would challenge banks in the US to use new technologies to converge branch and ATM channels to lower costs, unlock the consumer experience, and drive revenue growth.

Commercial bankers, Bryan Moore of Country Bank and Charles Maynard of Bankers’ Bank Northeast were in concert with their recommendations for driving new revenue for community banks and credit unions through small business lending. Yet, they acknowledged that reaching business owners is not easy and the competition is steep. Networking was one of the many tools they suggested using to find the elusive and very busy business owner of today.

Marketing and compliance working together? Now that’s a refreshing change! The GCAi digital marketing team acknowledged Marianne Byrne’s presentation with a standing ovation (well, enthusiastically from our seats anyway). Byrne, Director of New England at FIS, took on the incredibly tough task of presenting on “Developing Compliant Marketing Campaigns.” Using a variety of case studies, Byrne walked attendees though the steps of building successful and compliant campaigns. She also used her “compliance evil” to point out the many pitfalls. Her reaction to rewards programs? “I hate them!” because, she noted, regulators often target them for review. She urged attendees to show customers the benefit of the product, “Compliance and regulators will fall off their chairs.” Byrnes also offered her newly acquired fans a free ad review – certainly worth the price of a ticket right there!

Charlie Gross of WordCom and Bruce McMeekin of BKM Marketing helped their audience rediscover the value of direct mail. This experienced pair used case studies to instruct on targeting and connecting with prospects in the constantly evolving digital world. According to Gross and McMeekin, direct mail is making a comeback!

“As the present now,

Will later be past,

The order is Rapidly fadein’,

And the first one now,

Will later be last,

For the times they are a-changin”

Lessons well learned at the spring NEFMA conference in the beautiful setting of Ogunquit, Maine!